Why do a cumulative analysis?

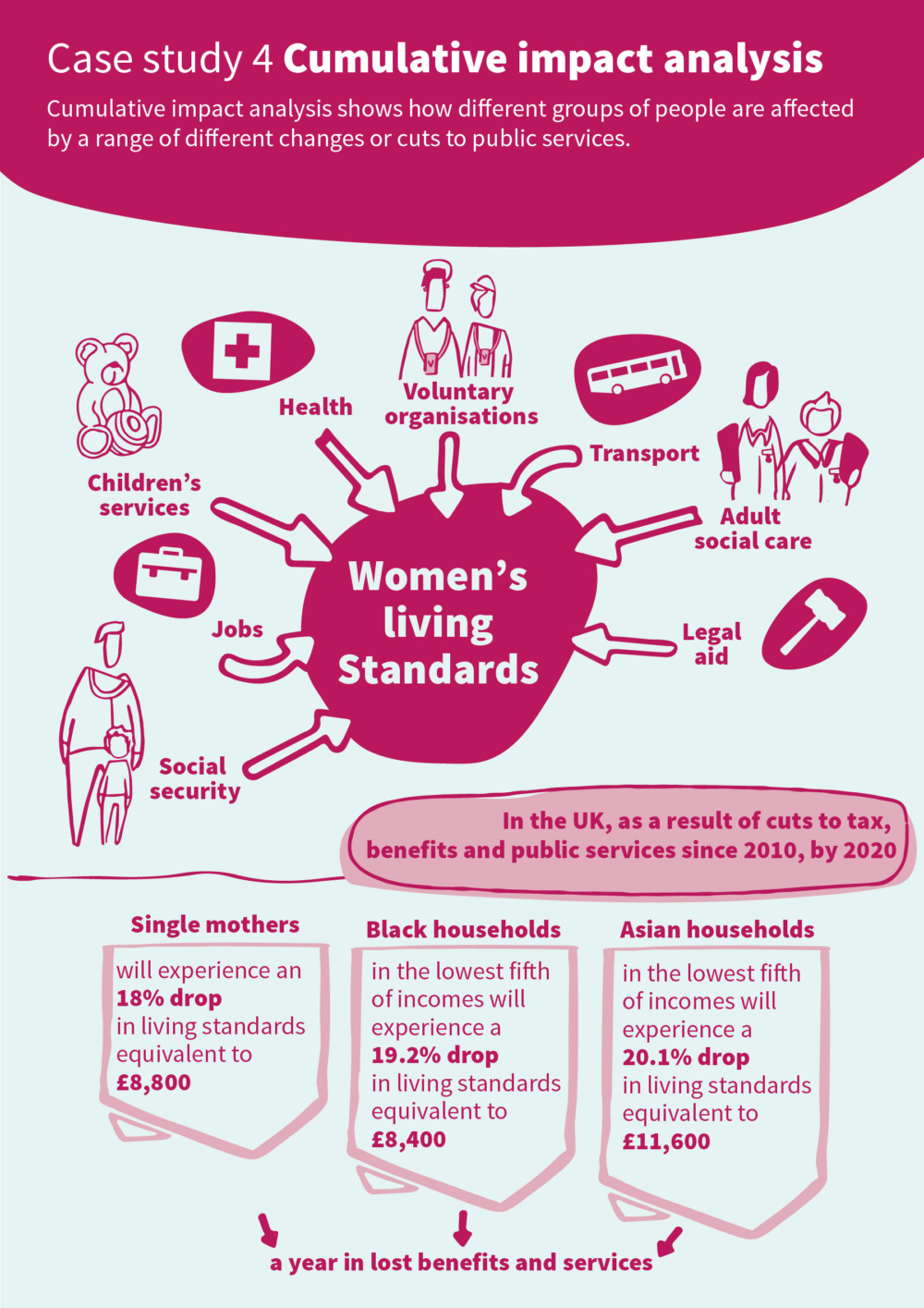

A cumulative analysis means looking at the combined impact of a number of measures. The effect of some individual measures may be small, but taken together the cumulative impact may be substantial.

For example, in the 2010 Emergency Budget the government announced a series of cuts and changes to spending on social security and public services.

The Women’s Budget Group knew that women would be disproportionately affected by these cuts, but we wanted to find out by how much, and specifically how much different groups of women and men would be losing. We carried out a series of cumulative impact analyses of the distributional impact of all cuts and changes to social security, spending on public services and tax policies from 2010 when cuts were first introduced, projected forward to 2020. Looking at the impact of policies over a period of time allowed us to account for the impact of policy reforms that are introduced in stages.

Analysis at both household and individual levels is important because there is gender inequality both between households and between individuals. Women tend to live in particular types of households, for example, single parents and single pensioners are more likely to be women in many countries, while working-age singles without children are more likely to be men. But there is also gender inequality between individuals, including between those who live in the same household, and this can only be captured at the individual level.

Our initial cumulative analysis focused on the living standards of households, looking at how the impact of changes in taxes, benefits and public services varied by household income and by ‘gendered household type’. Gendered household type classified households by gender, age and composition into: working age adults in couples, with or without children, working age single female and single male adults without children, working age female and male lone parents, retired couples, retired single females and single males. This allowed us to compare the impact of policy between couples and singles, and between single women and single men. It showed that female lone parents lost more of their disposable income and female lone pensioners more through cuts in public services than other household types.

In 2016, in partnership with the Runnymede Trust, a race equality think tank, we secured funding from the Barrow Cadbury Trust, a charitable foundation, which allowed us to extend our analysis of tax and social security changes to the impact on individuals as well as on households. It allowed us to consider the impact of cuts and changes not only by household income and gender, but also by race. There was substantial qualitative evidence that social security and spending cuts were hitting Black and Minority Ethnic (BME) women particularly badly and WBG felt that our analysis should also make this visible.