Tax remains a gendered issue for three main reasons:

- Forms of taxation have different impacts on women and men; these impacts are not only distributional but may affect behaviour too by giving people and companies a greater or reduced incentive to act in particular ways. For example, to spend less money on alcohol, or to invest profits or give them out as dividends.

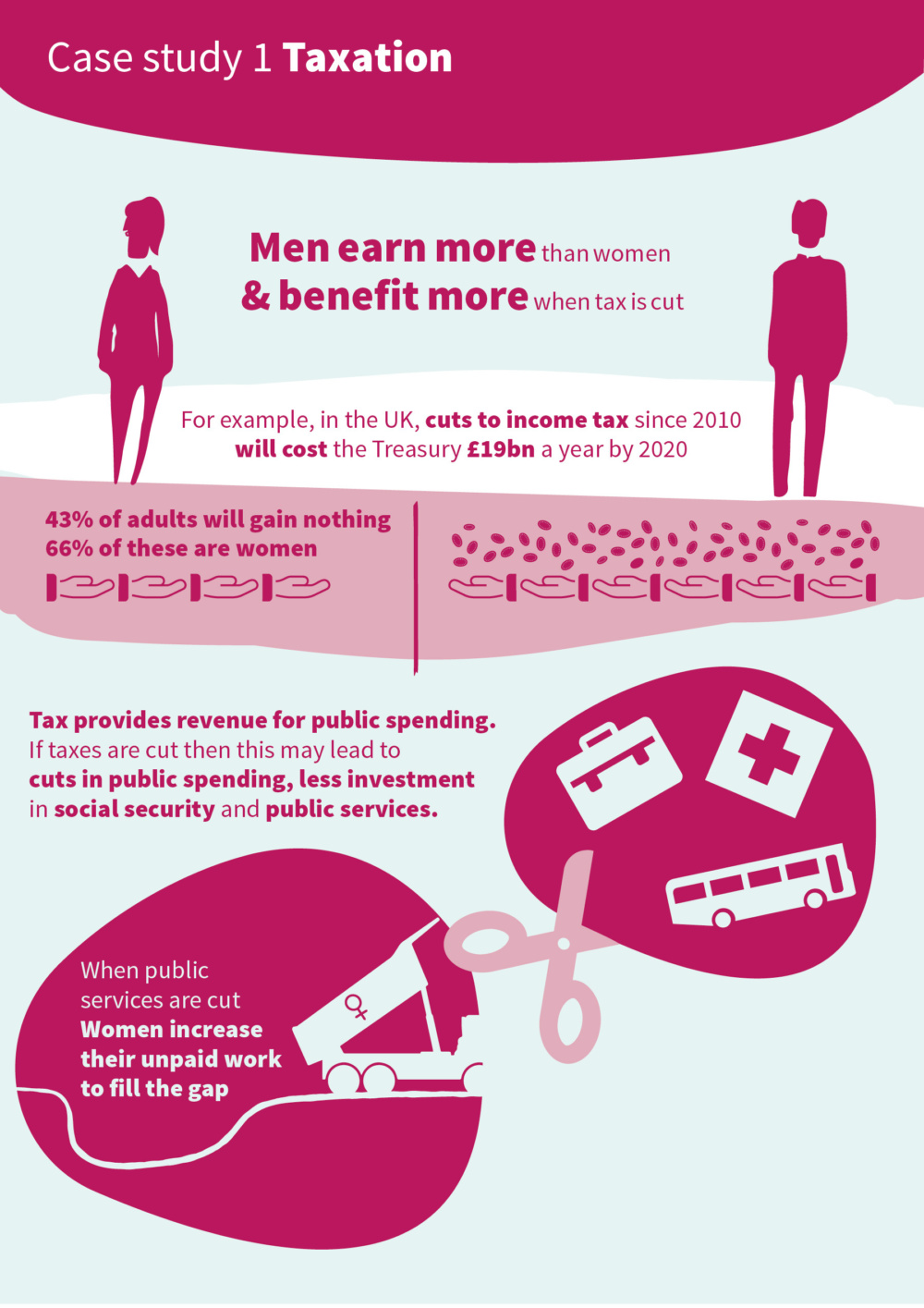

Tax policy enables governments to influence the economy in ways that may impact differently on men and women.

- Tax provides the revenue that is spent on investing in infrastructure, public services and social security benefits (cash transfers, sometimes called “welfare” benefits). Women, because of their caring roles, often are, or end up, more dependent on such expenditures than men.

Taxes that are equitably collected and raise adequate revenue are therefore important in promoting gender equality.

It is important to hold governments to account for the gender, and other equality, impacts of their taxation policy. There are political choices to be made about levels of taxation and of expenditure, and also about which specific taxes to levy. Even though it is usually quite easy to assess, governments may be unwilling to publish data on gender impact.

A fair tax system is critical to ensuring gender equality and tackling poverty.

It should:

- reflect people’s ability to pay;

- allow the government scope for economic and social policy, including raising money to fund good quality public services and social security;

- encourage desirable and discourage undesirable behaviour by people and companies.

The way in which specific taxes are designed and collected can also have important gender implications, by affecting the incomes that men and women have after paying tax and by influencing their behaviour, for example, by making employment more or less worthwhile.